dallas county texas sales tax rate

Combined with the state sales tax the highest sales tax rate in Georgia is 9 in the cities of. Texas is one of only 7 states not to have a state income tax.

Tax Information City Of Sachse Official Website

In 2021 the system had a ridership of 36970000 or about 118400 per weekday as of the first quarter of 2022.

. Dallas administrators reviewed Tuesday the citys 451 billion proposed budget for the 2023-24 fiscal year. Cities and counties without a local code do not charge a local sales and use tax. And hotels charge 6 of the price of your accommodations.

County and state tax rates. As for Texass business. City or County Rates.

Cause numbers are noted as withdrawn struck off or sold. Pennsylvania has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 2There are a total of 68 local tax jurisdictions across the state collecting an average local tax of 0166. Dallas Area Rapid Transit DART is a transit agency serving the DallasFort Worth metroplex of TexasIt operates buses light rail commuter rail and high-occupancy vehicle lanes in Dallas and twelve of its suburbs.

Not all Texas cities and counties have a local code. The gasoline tax is 20 per gallon. However along with that state rate counties and cities collect their own sales taxes.

The statewide rate is 65. The median property tax in Hays County Texas is 3417 per year for a home worth the median value of 173300. Combined with the state sales tax the highest sales tax rate in Pennsylvania is 8 in the cities.

El Paso TX Sales Tax Rate. 2020 rates included for use while preparing your income tax deduction. Sales results by month are posted on the Delinquent Tax Sales link at the bottom of this page.

Help us make this site better by. To obtain this authorization you must go to the Tarrant County Tax Assessor-Collectors Office 100 E Weatherford St. Dallas County Housing Market Trends Statistics July 2022.

The state sales tax rate 625 is above the national medium with localities adding up to 2 825 total. Rates include state county and city taxes. The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction along with the effective date and end date of each tax.

For a tax lien to be recorded for the previous tax year the filing must be received by the department by midnight on June 30. Hays County collects on average 197 of a propertys assessed fair market value as property tax. Broadnax said the proposed tax rate reduction represents the largest decrease.

Click here for a larger sales tax map or here for a sales tax table. These can total up to 6125 which means the total sales tax rates in some areas is as high as 12625. Fort Worth Texas Tarrant County Administration Building first.

Click here for a larger sales tax map or here for a sales tax table. Arkansas Sales Tax. In 2015 the Texas Legislature passed House Bill 855 which requires state agencies to publish a list of the three most commonly.

At the end of July 2022 a dwindling supply of active listings has pulled Dallas months of inventory MOI down to 18 months according to the latest data released by MetroTex the largest REALTOR association in North Texas. The latest sales tax rates for cities in Texas TX state. However the combined rate of local sales and use taxes cannot exceed 2 making the highest possible combined tax rate 825.

Denton TX Sales Tax Rate. For questions regarding Texas sales tax please contact. Arkansas has some of the highest sales taxes in the country.

Some localities add their own tax onto this which can raise the sales tax to as much as 825. Texas does have a back to school sales tax holiday once a year generally around the first weekend in August on clothing and footwear under 100. In July 2022 active listings in the area were up 112 from a year earlier.

Cigarettes will set you back 141 per pack. You will pay 625 taxes in Texas for everything you buy except groceries and medication. Georgia has state sales tax of 4 and allows local governments to collect a local option sales tax of up to 4There are a total of 470 local tax jurisdictions across the state collecting an average local tax of 3691.

Name Local Code Local Rate Total Rate. The figure is based on a property tax rate of 7458 cents per 100 assessed valuation a reduction of about 275 cents from last years rate. Hays County has one of the highest median property taxes in the United States and is ranked 118th of the 3143 counties in order of median property taxes.

Dallas TX Sales Tax Rate. Section 3203 of the Tax Code requires that all tax liens against manufactured homes be recorded with the Texas Department of Housing and Community Affairs.

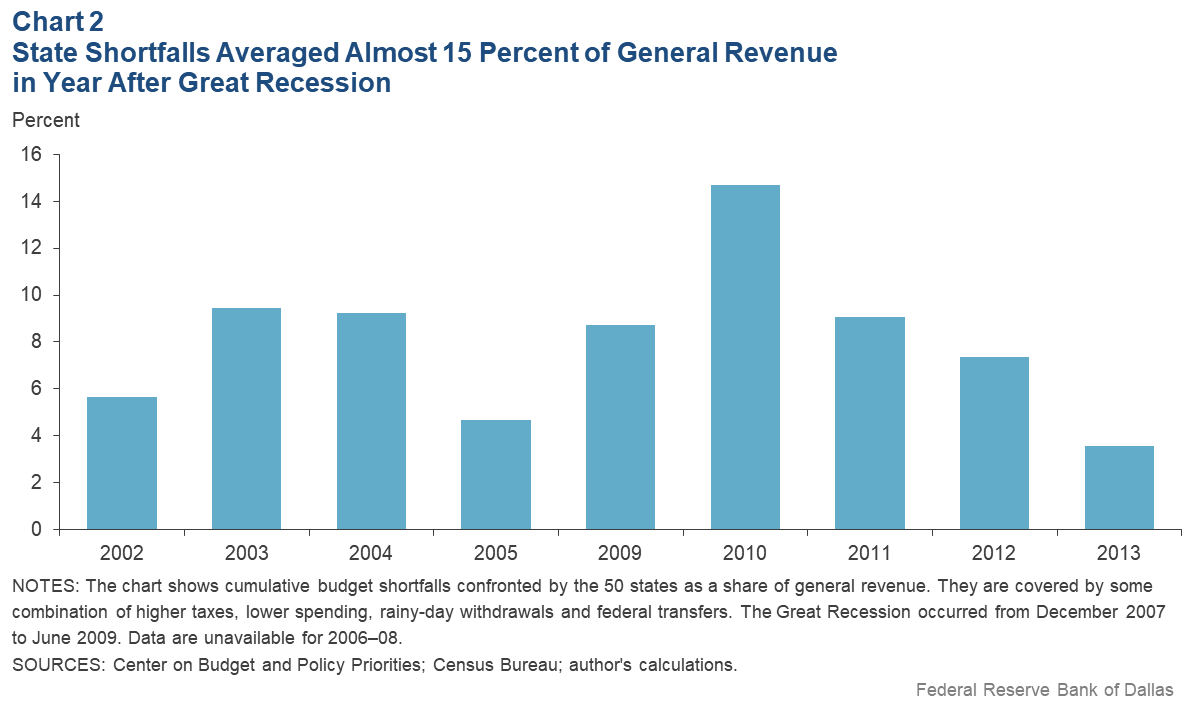

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

The Seller S Guide To Ecommerce Sales Tax Taxjar Developers

Texas Sales Tax Guide For Businesses

How To Charge Your Customers The Correct Sales Tax Rates

Tax Rates City Of Richardson Economic Development Department

2021 2022 Tax Information Euless Tx

How To Charge Your Customers The Correct Sales Tax Rates

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

How To File And Pay Sales Tax In Texas Taxvalet

Texas Income Tax Calculator Smartasset

Texas Vehicle Sales Tax Fees Calculator Find The Best Car Price

Dallas Texas Tx Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

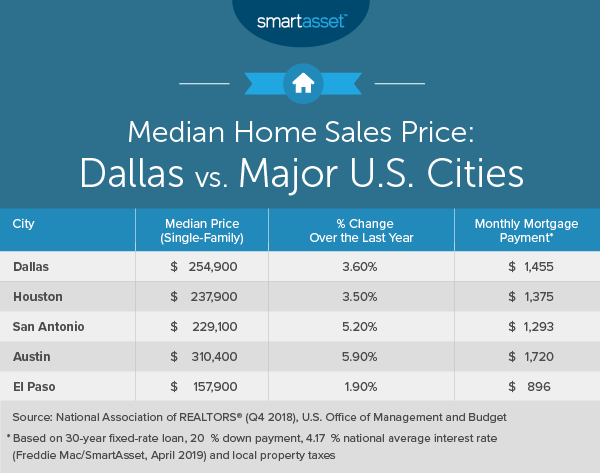

Cost Of Living In Dallas Smartasset

Why Are Texas Property Taxes So High Home Tax Solutions

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

How To File And Pay Sales Tax In Texas Taxvalet

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org